Lumpsum Calculator↗

Plan Your Investments with Lumpsum Calculator

EMI Calculator ↗

Calculate your loan payments instantly with the EMI Calculator

SIP Calculator ↗

Plan Your Investments with Ease with SIP Calculator

What is inflation?

Inflation refers to the steady increase in the overall price level of goods and services within an economy. It means that over time, the purchasing power of money decreases, so you need more money to buy the same things. This can happen due to various factors, such as increased demand, rising production costs, changes in government policies, or currency depreciation.

To tackle inflation, governments and central banks often employ measures like adjusting interest rates or controlling the money supply to keep prices stable and maintain economic balance.

How do I calculate inflation?

Inflation is calculated using a formula that compares the average price level of goods and services in the current period to a chosen base period. This comparison is typically expressed as a percentage increase or decrease.

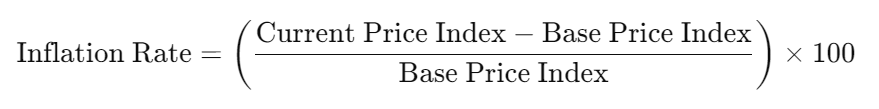

Here’s the simplified formula:

Inflation Rate=((Current Price Index−Base Price Index)/Base Price Index)×100

- Current Price Index: the average price level of the selected basket of goods and services in the current period.

- Base Price Index: the average price level of the same basket of goods and services in the chosen base period.

The resulting percentage indicates how much prices have changed over time. If the percentage is positive, it indicates inflation (prices have gone up), while a negative percentage indicates deflation (prices have gone down).

This method allows for the comparison of price changes over time and provides a measure of inflation that reflects changes in the cost of living.

Why is an inflation calculator important for daily life?

Inflation calculators are important for daily life for several reasons:

| Budgeting | They help people plan their expenses by showing how prices may change over time. |

| Financial Planning | Individuals can use them to ensure their savings and investments will keep up with rising prices. |

| Salary Negotiation | Understanding inflation rates aids in negotiating fair compensation to maintain purchasing power. |

| Investment Decisions | Investors can choose investments that outpace inflation to protect their real purchasing power. |

| Debt Management | Inflation affects the real value of debt; knowing its impact helps borrowers manage repayment effectively. |

Who calculates the inflation in the India?

In India, inflation is calculated and monitored by the Ministry of Statistics and Programme Implementation through the Central Statistics Office (CSO) and the National Statistical Office (NSO). The primary measure of inflation used in India is the Consumer Price Index (CPI). The CPI tracks changes in the prices of a basket of goods and services consumed by households across different regions and socioeconomic groups in India.

By comparing current prices to a base period, typically a reference year, the CPI helps to assess how the cost of living is changing over time in the country. This information is crucial for policymakers, businesses, economists, and individuals to understand the state of the economy and make informed decisions.

Who calculates inflation in the USA?

In the USA, inflation is typically calculated using the Consumer Price Index (CPI), which is published by the Bureau of Labor Statistics (BLS), a division of the U.S. Department of Labor. The CPI measures changes in the prices paid by urban consumers for a basket of goods and services over time. This basket includes a wide range of items such as food, housing, transportation, clothing, and medical care.

The calculation involves comparing the current prices of the items in the basket to their prices in a base period, which is typically set to represent a certain reference point (often a specific year). The percentage change in prices between the current period and the base period is then used to determine the inflation rate.

The CPI is one of the most widely used indicators of inflation in the United States and serves as a crucial tool for policymakers, economists, businesses, and consumers to monitor changes in the cost of living and make informed decisions.

Who calculates inflation in Canada?

In Canada, inflation is calculated by Statistics Canada, which is the national statistical office responsible for gathering, analyzing, and disseminating statistical information about Canada’s economic and social conditions. Similar to the USA, Canada also uses a measure called the Consumer Price Index (CPI) to track changes in the prices of goods and services over time.

The CPI reflects the purchasing habits of Canadian households by measuring the price change of a basket of goods and services commonly purchased by consumers. This index is used to monitor inflation and helps policymakers, economists, businesses, and consumers understand how prices are changing in the Canadian economy.

Who calculates inflation in the UK?

In the United Kingdom, inflation is calculated and monitored by the Office for National Statistics (ONS). The ONS is the official statistical agency responsible for collecting and analyzing data on various aspects of the UK economy and society. Similar to other countries, the UK uses the Consumer Price Index (CPI) as its primary measure of inflation.

The CPI tracks changes in the prices of a basket of goods and services purchased by households across the country. By comparing current prices to a base period, the CPI helps to gauge how the cost of living is changing over time in the UK. This information is essential for policymakers, businesses, economists, and individuals to understand the state of the economy and make informed decisions.

What is deflation, or reverse inflation?

Deflation refers to a general decrease in the price level of goods and services, leading to an increase in the purchasing power of money. It’s the opposite of inflation, where prices generally rise over time. So, if you encounter the term “reverse inflation,” it likely refers to deflation.

Deflation can happen due to various factors, such as reduced consumer demand, increased productivity, or technological advancements that lead to lower production costs.

While a decrease in prices might seem beneficial to consumers at first glance, sustained deflation can have negative consequences for the economy. It can lead to reduced business investment, lower wages, and increased debt burdens, which can ultimately hinder economic growth and stability.

It’s essential for policymakers to monitor both inflation and deflation trends closely to maintain a stable economic environment.